LQUID PAY:

Spend Crypto Anywhere, Anytime

LQUID PAY is making cryptocurrency as easy to use as cash.

With our non-custodial payment card and app, powered by Visa, you can spend crypto securely and instantly at millions of locations worldwide.

Whether you're shopping or running a business,

LQUID PAY bridges the gap between digital assets and real-world payments.

Why LQUID PAY?

Crypto is growing fast, but using it for everyday purchasescan be a challenge.

Here’s how LQUID PAY makes it simple:

1. Use Crypto Like Cash

Most stores don’t accept crypto, but with LQUID PAY, you can pay anywhere Visa is accepted, turning your digital assets into real

spending power.

2. Keep Your Money Safe

Traditional wallets and exchanges can be risky. LQUID PAY’s

non-custodial system puts you in full control of your funds, keeping them secure from hackers.

3. Low Fees & Great Exchange Rates

Converting crypto to cash is often expensive. LQUID PAY offers competitive exchange rates and low fees, so you get the most value from your money.

4. Fast & Easy Payments

Crypto transactions can be slow and complicated. With LQUID PAY’s instant payments, you can spend your digital assets just as easily

as using a debit card.

5. Simple Crypto Payments for Businesses

Many businesses avoid crypto due to price changes and regulations. LQUID PAY allows them to accept digital payments and settle transactions in their preferred currency, making crypto adoption easy and stress-free.

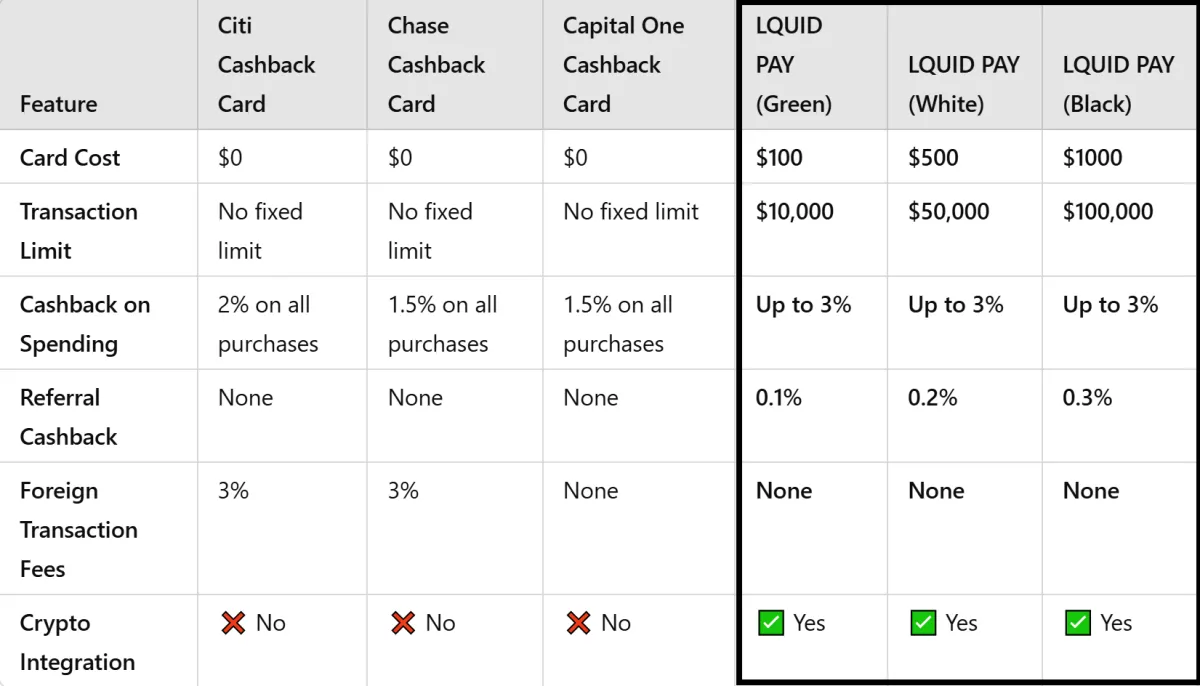

Cashback Card Comparison

LQUID PAY offers transparent and flexible pricing with

cashback rewards, making crypto payments even more rewarding.

Comparison Insights:

Citi, Chase, and Capital One have no fixed transaction limit, meaning you can spend as long as you have the available credit on your card. In contrast, LQUID PAY cards have set transaction limits based on the card tier.

Traditional cashback cards like Citi, Chase, and Capital One offer lower cashback rates, usually between 1.5%-2%.

LQUID PAY offers higher cashback of up to 3%, plus referral cashback when friends and family spend.

Traditional banks do not integrate crypto transactions, while LQUID PAY enables seamless CRYPTO SPENDING.

LQUID PAY has no foreign transaction fees, unlike Citi and Chase, which charge 3% per international transaction.

Unlike Citi, Chase, and Capital One, which have no card fees, LQUID PAY requires an upfront card cost but compensates with higher transaction limits and CRYPTO BENEFITS.

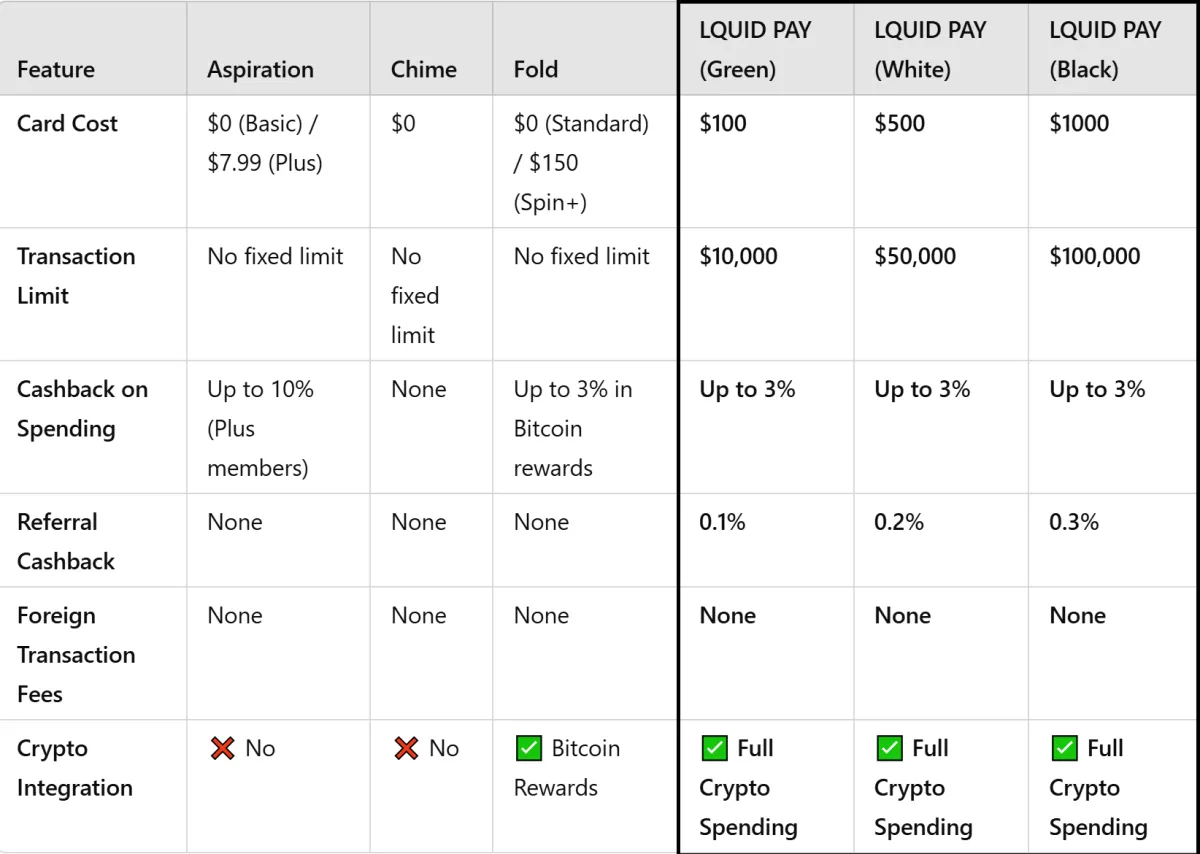

Cashback Card Comparison

LQUID PAY offers transparent and flexible pricing with

cashback rewards, making crypto payments even more rewarding.

Comparison Insights:

Aspiration, Chime, and Fold have no card fees for their basic versions, while LQUID PAY requires an upfront cost but provides high crypto spending limits and cashback benefits.

Fold offers $150 (Spin+): This is the paid premium version that costs $150 per year.

Aspiration offers up to 10% cashback, but only for Plus members. Fold offers up to 3% cashback in Bitcoin, whereas LQUID PAY provides up to 3% cashback in crypto or fiat.

Chime does not offer cashback on spending, making it less rewarding compared to the other options.

Only Fold and LQUID PAY integrate with cryptocurrency, but LQUID PAY allows direct crypto spending, while Fold only provides Bitcoin rewards.

LQUID PAY is the only option that provides referral cashback (0.1%–0.3%), making it ideal for those who want to earn rewards from others’ spending.

How to get Started:

Must listen to: https://youtu.be/-BJf_0WsUoE?si=b_Js9SSVB3uomp6K

Step 1: Claim Your FREE LQUID Demo Card (Available Until Feb 28)

Step 2: Download the LQUID PAY Mobile App for iOS or Android

Step 3: Complete KYC Verification to activate your card

Step 4: Use your demo card and experience seamless crypto spending This first version works with USDT (Polygon)

Step 5: After Feb 28, cards will require full payment—don’t miss out!